Recent Voting Trends on ESG Proposals

This article reports on voting trends for the following two proposals:

THE “2 DEGREE PROPOSAL”

An environmental proposal requesting that the company prepare a scenario analysis on the company’s financial outlook in a carbon constrained world

THE “BOARD DIVERSITY PROPOSAL”

A social proposal focused on the gender diversity of board directors

We approached this article believing that these two proposals have stood out in both their popularity with proponents as well as their acceptance among shareholders. With the help of our proprietary Institutional Research and Analytics Database (“IRaAD”), we will test our hypothesis that these proposals are: 1) becoming increasingly popular and more palatable to institutional investors; and 2) gaining greater overall support at shareholder meetings.

2 DEGREE PROPOSAL

What is a 2 Degree Proposal?

A 2 Degree Proposal asks issuers to perform a scenario analysis and report on how the company would perform in a business environment where greenhouse gasses, specifically carbon dioxide, are constrained with the goal of limiting the warming of the atmosphere to 2 degrees celsius above preindustrial levels. These analyses look at the break even points under different levels of demand for the issuer’s product(s) – typically fossil fuels.

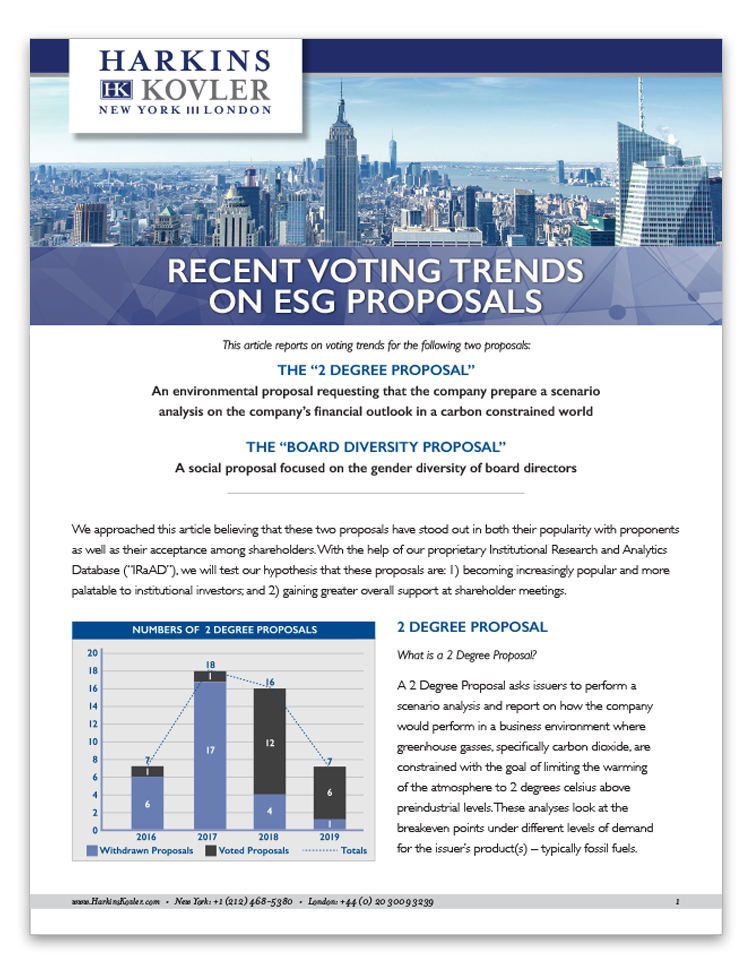

In 2016, we saw an increased number of proposals that fall under this category. Two events may have contributed to this increase. First, in 2015, both Shell and BP’s management supported shareholder proposals that requested this scenario analysis. This indicated to institutional investors, ESG activists and issuers that there was potential merit in this type of proposal and business practice. Second, the prospect of a carbon constrained world became an increasing reality with the signing of the Paris Climate Change Agreement. As a result of these two events, 2 Degree Proposals increased from being nearly non-existent among U.S. issuers in 2015 to 7 proposals in 2016, 18 proposals in 2017 and 16 proposals in 2018. In 2019, seven 2 Degree Proposals were brought to issuers. However, 6 of these proposals were withdrawn, presumably as a result of negotiation between the issuer and the proponent. Withdrawn proposals were also common in 2018. Finally, it is possible that the pressure proponents are putting on companies is even greater than the numbers suggest. While in 2016 and 2017, companies showed a reluctance to negotiate on proposals, the fact that they were willing to do so in 2018 may suggest that there is even more dialogue between companies and proponents on climate change issues than is indicated by a mere review of the number of proposals submitted with or without withdrawals. This could be a factor in the decline of 2 Degree Proposals in 2019.

Additionally, levels of support for this proposal were substantially higher than those witnessed for other climate change proposals. In 2016, 2 Degree Proposals received median support levels of 39%, increasing to 43% in 2017 and 49% in 2018. This contrasts with significantly lower median levels of support for comparative GHG proposals of 23% in 2016, 24% in 2017 and 30% in 2018. Furthermore, while environmental shareholder proposals have historically failed to receive majority support, 2017 and 2018 each saw two 2 Degree Proposals gain greater than 50% of the votes cast. In 2017, a 2 Degree Proposal at PNM Resources, Inc. received 56.8% support and a 2 Degree Proposal at Occidental Petroleum Corporation received 67.3%.

WHY HAS THE 2 DEGREE PROPOSAL GAINED TRACTION?

The overall increase in the level of support can be attributed to a variety of factors. Heightened focus on ESG issues at asset managers, the less proscriptive nature of the 2 Degree Proposal and the close tie of environmental issues to the financial performance of the companies that have received these proposals have contributed to increased institutional investor support for these proposals.

On average, the top 10 institutional investors, ranked by equity assets under management supported the 2 Degree Proposal approximately 41% of the time in 2016, but this rose to 48% in 2017 and 56% in 2018.

This increase in institutional support was driven largely by the change in voting behavior of three firms: Vanguard, BlackRock and Fidelity. In 2016, these firms did not support 2 Degree Proposals. But, in 2018 Vanguard and Blackrock both supported 60% of the 2 Degree Proposals on which they voted, while Fidelity supported all of the 2 Degree Proposals on which it voted.

Depending on an issuer’s shareholder profile, this shift in support can have a significant impact on the outcome of the shareholder vote on the proposal. An example of this can be seen at Occidental Petroleum. The same 2 Degree Proposal was submitted to Occidental Petroleum in both 2016 when it was supported by 49% of the shares voted and 2017 when it was supported by 67% of the shares voted. The chart below illustrates the shift in institutional voting and ownership between those years. Three of the top five Institutional Investors representing approximately 11% of Occidental’s outstanding shares changed their vote to support this proposal in 2017.

BOARD DIVERSITY PROPOSAL

What is a Board Diversity Proposal?

The second shareholder proposal that we examined for this article falls into the category of social proposals and deals with board diversity. Specifically, this style proposal tends to ask for one of two actions: a report on how the company plans to increase the racial and gender diversity on the board; and one that requests that the board adopt a policy to ensure that nominees for election as directors include qualified women and minority candidates.

Unlike the 2 Degree Proposals that typically are submitted at companies in the Oil & Gas sector, Board Diversity Proposals have been submitted to companies operating in a diverse set of industries. We compared the levels of support that Board Diversity Proposals received to similar shareholder proposals that target social issues. We found that, like the 2 Degree Proposal, Board Diversity Proposals have gained substantially greater levels of support than the support garnered by similar social proposals. In 2015, the median level of support for Board Diversity proposals was 16% compared with 5% for other social proposals. The gap was maintained in the following years. In 2016, 2017 and 2018, support levels were 17% vs. 9%, 19% vs. 10% and 25% vs. 10%, respectively.

Superior support can be attributed to several factors. First, the emphasis on board refreshment in prior years may have impacted how corporate governance departments at institutional investors viewed the merits of board diversity. Institutional corporate governance departments are increasingly willing to assert their opinion as to the makeup of boards and are increasingly looking to understand the skillsets brought by each director. Second, initiatives such as “2020 Women on Boards” have brought attention to gender diversity. They also have underscored the tie between board diversity and positive financial performance / risk mitigation. Similarly, the focus of this shareholder proposal corresponds to trends seen in society. Gender equality has gained momentum during the past half-decade, leading to increasing awareness of workplace behavior and inequality of pay between genders.

SUPPORT AMONG INSTITUTIONAL INVESTORS

The voting patterns of institutional investors on Board Diversity Proposals changed significantly over the four-year period studied. In 2015, 7 of the top 10 institutional investors never voted for Board Diversity Proposals. But, by 2018, only 1 of the top ten institutional investors was not inclined to support Board Diversity Proposals. Perhaps unsurprisingly, institutional investors were more willing to support the version of the Board Diversity Proposal that requested a report as opposed to a Board Diversity Proposal requesting a policy because a report focuses attention on the issues presented and is less proscriptive than a policy.

The graph set forth above, entitled “Institutional Support for Board Diversity Proposals,” illustrates the increased propensity of the top 10 institutional investors to vote for Board Diversity Proposals over the four-year period ended 2018.

Average support increased from 22.5% in 2015 to 33.3% in 2016, 41.0% in 2017 and 51.1% in 2018. Additionally, for proposals requesting reports on board diversity, 4 of the top ten institutional investors went from supporting none of these proposals in 2015 to supporting all of these proposals in 2018.

RESULTS

Board Diversity Proposals have garnered majority support at several companies, including Hudson Pacific (2017), Cognex Corp. (2017) and FleetCor Technologies Inc. (2016). And, ISS has announced a policy to “generally vote against or withhold from the chair of the nominating committee at companies where there are no women on the company’s board,” starting in February of 2020. As a result, we can expect issuers to be more focused on the profiles of their directors, including the split in the boardroom between male and female directors.

IMPLICATIONS FOR INCUMBENT BOARD AND MANAGEMENT TEAMS

From our collection and analysis of the data, we concluded that 2 Degree Proposals and Board Diversity Proposals have indeed gained significantly higher traction than other similar proposals. Understanding the components that have contributed to the success of these proposals enables issuers to proactively develop strategies to cope with ongoing challenges in the form of environmental and social proposals.

From our analysis, the single largest contributing factor to the success of these proposals has been the change in voting behavior of institutional investors. If the share of assets under management controlled by institutional investors continues to increase as it has for the past few decades, their voting policies will determine the outcomes of future votes on these proposals.

When confronting an ESG issue, the issuer’s strategy must be informed by how its shareholders have communicated their views on the issue via engagement, as well as in their historic voting. Proposals establishing a clear link between environmental or social issues and the financial performance of the issuer are likely to undergo additional scrutiny by institutional investors. Furthermore, proposals linked to specific ESG issues that institutional investors have championed and proposals linked to societal paradigm shifts have a greater likelihood of garnering high levels of support.

If an issuer has been targeted by a shareholder proposal, an analysis of the issuer’s shareholder base should be performed to gain insight into how its shareholders historically have decided on the issue presented. Should the analysis show that a substantial portion of shareholders are inclined to support a proposal, directors should educate themselves on the issue by understanding which KPIs are traditionally used to measure performance. Directors also should understand how their company’s performance compares to the industry benchmark.

Neither the 2 Degree Proposal nor the Board Diversity Proposal will be the last ESG or social proposal to gain majority support. Under the backdrop of increasing director engagement, board members will increasingly be asked how ESG risks and opportunities are being managed and shareholders will always be interested in board views regarding social movements of general interest to all concerned.

Separate and apart from the debate over the merits of these proposals, the share ownership profile of the issuer determines its overall vulnerability to an activist campaign. However, share ownership profiles differ from one issuer to the next.

The share ownership profiles of some issuers make them easy targets for an activist agenda (e.g., insignificant ownership by directors, officers and employees, together with insignificant ownership by retail investors, substantial hedge fund ownership and substantial ownership by institutional investors with a demonstrated propensity to support ESG proposals), while the share ownership profiles of other issuers present what may be insurmountable challenges for an activist (e.g., substantial ownership by directors, officers and employees, together with substantial ownership by retail investors, insignificant hedge fund ownership and substantial ownership by institutional investors with a demonstrated propensity to vote as recommended by the incumbent board). And, as you might expect, the share ownership profile of most issuers presents some combination of the two extremes described above – not exactly an “easy target” for activists, but not “invulnerable” either.

For these reasons, among others, every issuer should know its own share ownership profile – specifically, how many shares are controlled by: officers, directors and employees (including shares controlled by employee plans); retail investors; institutional investors (including the mix of active and passive – or indexed – ownership, as well as the mix of investment strategies employed among the actively managed funds); hedge funds; and, if applicable, known activist investors. In addition, issuers should know the demonstrated voting preferences of their institutional owners (or, at least, the demonstrated voting preferences of their top fifty or one hundred institutional investors), including the extent to which these investors have adhered to the voting recommendations of ISS and Glass Lewis, based on actual voting and not merely conjecture, anecdotes or hearsay.

Our studies of institutional voting on ESG proposals have shown that, generally speaking, actual support for these proposals varies widely from one institutional investor to the next and from one year to the next in an evolving landscape, ranging from 0% to 100% of the votes cast, with some institutional investors adhering rigidly to the voting recommendations of ISS or Glass Lewis and others remaining flexible with respect to the voting recommendations of ISS and Glass Lewis. Knowing each investor’s demonstrated propensity to support ESG proposals, as well as each investor’s demonstrated propensity to vote as recommended by (or contrary to the recommendations of) ISS and Glass Lewis, enhances the accuracy of the vote projection models that can be used in the strategic planning stages of an issuer’s response to an ESG proposal and ensures the efficient allocation of board and management resources in marshaling support for the board’s position in the actual vote by stockholders.

For example, when planning an investor meeting program in response to an ESG proposal opposed by the board, it makes sense to assign priority to those institutional investors who are most likely to support the incumbent board based upon historical voting on the same or similar issues. And, if ISS and/or Glass Lewis has or have recommended contrary to the incumbent board’s voting recommendation, it makes sense to adapt to that setback by assigning priority to institutional subscribers who have demonstrated the greatest propensity to vote contrary to the recommendations of ISS and/or, as the case may be, Glass Lewis.

A detailed understanding of the issuer’s share ownership profile will enhance the issuer’s ability to cope with a wide range of challenges (e.g., problematic shareholder proposals) and to act on the opportunities presented (e.g., improved engagement with institutional investors). Given the demonstrated overall predisposition

of institutional investors to support incumbent board and management teams, issuers are well advised to nurture this asset by establishing reliable communications with their institutional investors. In turn, enhanced communications will promote greater understanding and cooperation, leading to increased investor support for the incumbent board and management team long before a vote occurs.

Depending on their needs, our clients subscribe to periodic share ownership profiles, supplemented

by detailed accountings of institutional voting on relevant ESG proposals, as well as on a wide range of other shareholder-sponsored proposals, including precise measurement of institutional adherence to the voting recommendations of ISS and Glass Lewis. These reports are based on IRaAD (our proprietary Institutional Research and Analytics Database) and, when appropriate, our reports are supplemented by vote simulations based on prior institutional voting on the same or similar issues. Our findings, conclusions and recommendations are highlighted in board presentations and usually are incorporated into the issuer’s ongoing investor relations efforts, including enhanced engagement with key investors.

If you would like to learn more about our services, including the advanced analytical tools available for use in assessing institutional investor voting preferences through IRaAD, please contact us.

Inquiries are welcome and held in strict confidence.